18 July 2023

Back to School Costs 2023

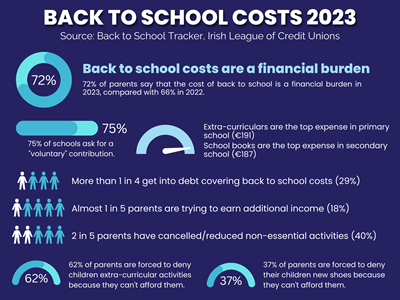

LCU Back to School Tracker 2023 shows significant increase in parents feeling financial burden

The Irish League of Credit Unions has today published the results of its annual School Costs survey, tracking the costs and impacts of children returning to school. 723 parents (out of a sample size of 2,510) from across Ireland responded to the survey, which was conducted by i-Reach Insights during June.

72% of parents say that covering the costs of back to school is a financial burden compared to 66% in 2022. Parents are spending €1,152 per primary school child (2022: €1,195) and €1,288 per secondary school child (2022: €1518).

Commenting on the findings, Mr David Malone, CEO, Irish League of Credit Unions said;“Our 2023 survey shows that parents continue to feel a considerable financial burden educating their children. While we have seen a slight reduction in the amount being spent per child on back-to-school costs compared to 2022, general cost of living increases are impacting on households. So, while the reduction in back-to-school costs are welcome, it is partly due to parents cutting back on extra-curricular activities and we still have parents getting into debt to cover back-to-school costs.

“The average level of debt is €306 with 17% of parents having debts of over €500. We are also seeing the same number of parents getting into debt compared to last year (29% both years). Thankfully, the message on getting a credit union loan rather than using Payday or money lenders for help with back-to-school expenses seems to be getting through. For back-to-school supplies, 4% will seek a credit union loan and no respondent said they would go to a bank or moneylender. This is the type of community need which Credit Unions meet every day”.

Mr Malone said that more generally, cost of living increases are impacting all households and 40% of parents of school children have cancelled or reduced non-essential services / activities to cover rising costs. More concerning is that 18% of parents of school children are trying to earn additional income and the potential impact this might have on family life.

“13% of parents said they were seeking a loan to cover additional household costs with 2% saying they would go to a money lender to do so. Again, we would urge anyone needing help with household costs, particularly those who feel they have no option but to use a money lender to talk their local credit union. The cost of the loan will be cheaper – we’re answerable to our members, not to shareholders demanding big profits and a new member can join and apply for a loan on the same day”.

Mr Malone added that he was hopeful that the introduction of the free primary school book scheme will reduce the need for parents to get into debt in future years. “It is surprising that nearly half (49%) of parents have not been informed of the scheme by their school, and a number of those parents (39%) are intending to purchase school books outright this year. However, we hope to see the full impact of the scheme in our survey next year”