04 September 2025

Updates to Current Account Terms and Conditions

We are making changes to our Current Account and Debit Card Terms and Conditions. Please read more information about these changes below.

No action is needed from you. If you are satisfied with the changes, you can continue to use your account as normal. If you choose not to accept the changes, you may close your account in line with the terms and conditions.

Updated PDFs of our Terms and Conditions and Fees & Charges Notice are available below. There are no changes to our Fees & Charges structure, but the document itself has been updated to reflect changes to terms and conditions.

If we do not hear from you by 09/11/2025, we will take it that you are satisfied with the changes to your Current Account Terms and Conditions. If you are not satisfied with the amendments, you are free to close your account in line with the terms and conditions.

Summary of Key Changes

Accessibility

In line with the European Accessibility Act, we are committed to making our services more accessible to all. These updated documents meet European Accessibility Act requirements.

Definitions

Clause 3 (Definitions) has been updated to provide further clarity.

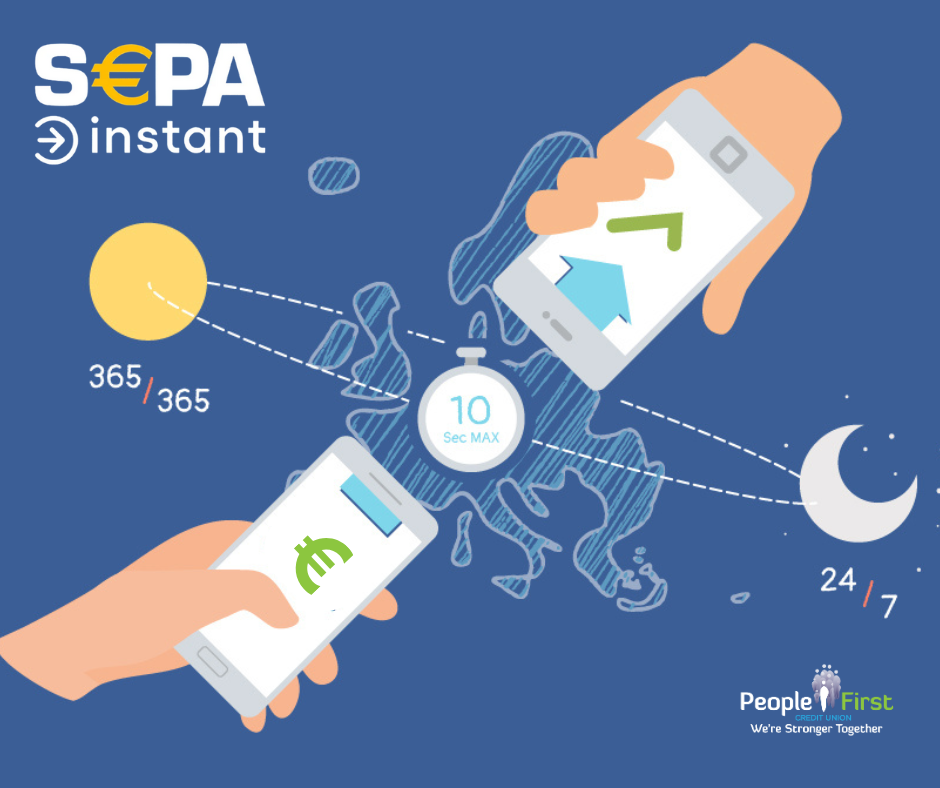

- "SEPA Instant Credit Transfer" has been added.

- "Verification of Payee" has been added.

- References to "Mastercard" have been replaced with references to "Card Scheme". "Card Scheme" covers both "Mastercard" and "Visa".

Sole Traders

Clause 4.2 (Opening Your Account) has been updated to enable us to offer "sole trader" accounts in the future.*

Clearing and Cut-Off Times

Clause 8.3 (Lodgements and Payments to Your Account) has been updated to reflect the time it takes to clear cheques lodged to your account. This has been changed from "up to 5 Business Days" to "up to 10 Business Days".

Clause 10 (Clearing and Cut-off Times) has been updated to reflect the introduction of SEPA Instant Payments.

Non-Resident in Republic of Ireland

Clause 61 (Ending this Agreement and Interruption to Services) has been updated to include information on how we may cease your account "if you are not resident in the Republic of Ireland.

Clause 32 (Termination, Cancellation or Suspension of Your Debit Card) has been updated to include information on how we may terminate your card "if you are not resident in the Republic of Ireland".

Death of Accountholder

Clause 19 (Death of Accountholder) has been added to explain how we deal with your account upon your death.

Credit Interest

Clause 52 (Credit Interest) has been added to explain that we may apply credit interest on your account.

Foreign Currency Transactions

Clause 28.2 (Use of Debit Card Abroad or in Foreign Exchange Transactions) has been expanded to include more information on currency conversion for non-Euro transactions.

SEPA Instant and Verification of Payee

Clause 5 (Payment Instructions) has been updated to reflect changes to cut-off times resulting from the introduction of SEPA Instant Payments.

Clause 10 (Clearing and Cut-off Times) has been updated to reflect changes to clearing and cut-off times resulting from the introduction of SEPA Instant Payments.

Clause 13 (Standing Orders) has been updated to reflect changes to standing orders resulting from the introduction of SEPA Instant Payments.

Clause 14 (Credit Transfers) has been updated to reflect changes to credit transfers resulting from the introduction of SEPA Instant Payments.

Clause 15 (Payments from Your Account) has been updated to reflect changes to how payments are made from your account resulting from the introduction of SEPA Instant Payments.

Clause 16 (Payment Errors and Unauthorised Transactions) has been updated to reflect how errors and unauthorised transactions are handled resulting from the introduction of SEPA Instant Payments and Verification of Payee.

*The change to Clause 4.2 to include sole traders does not mean that the credit union now offers these accounts. It gives us the option to do so in the future.